In the rapidly evolving digital landscape, businesses face an unprecedented level of cyber threats,

Menu

World Economic Forum says cyber crime equals third largest economy

Cyber attacks are becoming the most critical risks and is expected to cross $10 Trillion by 2025. Too many organizations are shocked when they experience a cyber attack and data breach. The ability to find and address IT vulnerabilities and prevent cyberattacks before they happen is becoming increasingly difficult given the sophistication of the hackers.

For Brokers

- Helps transition from being a ‘Transactional’ broker to one that is ‘Relationship and Value-Driven’

For Insurers

- Assess risks better and gain increased confidence in underwriting by following a more standardized framework

For Insured

- Elevate Risk Posture. Keep Premiums Lower and never get declined for Cyber Insurance coverage

Do you have what it takes to keep claims lower?

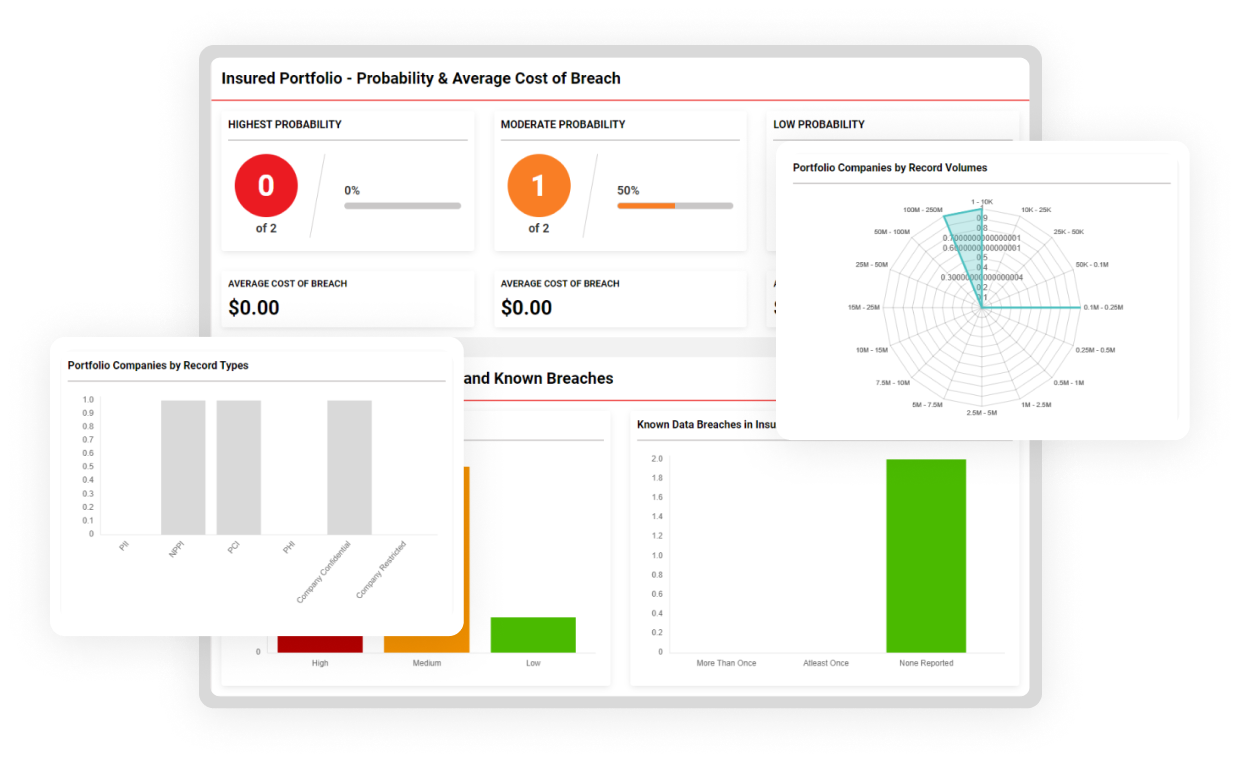

To keep claims lower and make cyber insurance products more affordable, cyber insurance providers will require a platform that will help insurance brokers and insurance carriers monitor technology risk of insured companies, feed into underwriting, and help the insured companies improve risk posture.

- Quick and easy access to cyber risk insights.

- Automated and enhanced cyber risk assessments for underwriters.

- Elevate cyber risk posture of your insured.

- Achieve regulatory compliance with ease and avoid penalties.

Cyber Risk Insights

Monitor Vulnerabilities

Automated Assessments

Cyber Maturity

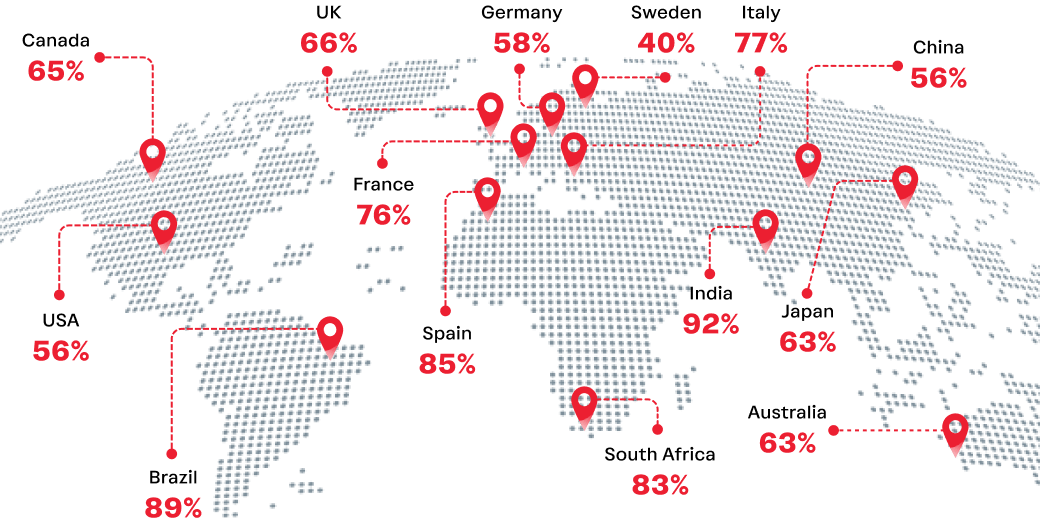

83% of all C-Level respondents globally report that their company is not adequately protected against cyber threats.

How concerned are you about a potential attack on your company?

The world map below shows the percentage of C-level executives concerned about a potential cyber-attack on their company.

Recent Articles

When Cyber Insurance was introduced, the exposures were thought to be about Privacy.

In an era where businesses are increasingly reliant on digital technologies, the threat of cyberattacks looms large.

Frequently Asked Questions

Businesses more than ever will need to protect from financial losses and ensure Cyber Insurance is part of their coverage. We can help your organization improve your risk posture.

Cyber insurance, also known as cybersecurity insurance, is a type of business liability insurance that protects your business against cyber security risks and data breaches. Cyber insurance can help restore employee and customer identities, recover compromised data and repair damaged computers and networks, whether your business is the victim of a data breach, social engineering, ransomware or phishing attack.

Your business could be at risk for a cyber attack. A growing number of small and medium-sized enterprises (SMEs) get attacked each year. Many businesses are without the support of cyber insurance coverage. The recent pandemic and increase in remote working makes computer systems more vulnerable. And if your systems or data are compromised, it can put you out of business or cause a significant financial loss.

85% of data breach insurance claims come from small to medium-sized businesses, and more than 60% of those businesses never recover from a data breach. Regularly backing up your data is one way to minimize the damage that can occur if your business is compromised. If a computer is stolen or your network is infected with a virus, for example, the backups can enable your business to get back on its feet sooner. Talk to us. We can help.

- Legal and civil damages: Paying for legal representation and possible damages related to a privacy or network security breach;

- Security breach remediation and notification expenses: Notifying affected parties and mitigating potential harm from a privacy breach, such as providing free credit monitoring;

- Forensic investigations expenses: Hiring a firm to investigate the root cause and scope of the data breach;

- Computer program and electronic data restoration expenses: Restoring or recovering damaged or corrupted data caused by a breach, denial-of-service attack or ransomware.

Improve your risk posture : We can help your organization improve your risk posture by implementing security controls to mitigate risk. Talk to our experts today.

- Data confidentiality breaches: The loss of and/or unauthorized access to or disclosure of confidential or personal information;

- Cyber extortion: A demand for payment under threat of causing harm to your data; for example, disabling your operations or compromising your confidential data;

- Technology disruptions: A technology failure or denial-of-service attack.

- How many records containing personal information does your organization retain or have access to?

- How many records containing sensitive commercial information does your organization retain or have access to?

- What security controls can you put in place to reduce the risk of having your system compromised?

- Do all portable media and computing devices need to be encrypted?

- Is unencrypted media in the care, custody or control of your third-party service providers?

- Could you make a claim if you were unable to detect an intrusion until several months or years had passed?