In an era where data security and privacy are paramount, businesses handling sensitive information

Sell more cyber insurance faster

- Effectively market and sell more Cyber Insurance 10x faster and grow top line.

- Automated online application, risk assessment. Easily integrate with your customer facing website.

- Electronically transmit ‘quote-ready’ applications to the insurance carrier or underwriter.

- Generate additional revenue stream by providing Risk Management solutions to your clients.

- Meet regulatory requirements related to Information and Cyber Security guidelines or regulation.

Sell More, Sell Fast

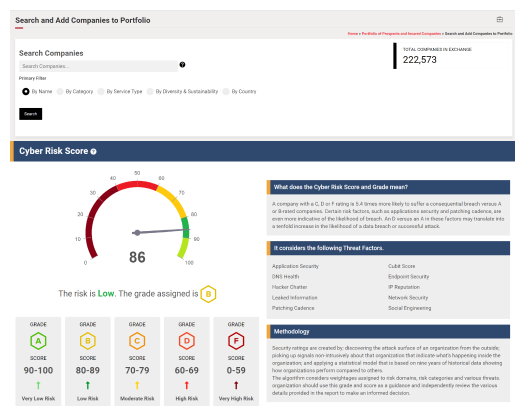

Smart Prospecting

How it works?

Easily build Portfolio from database

Generate KYC & Cyber Report

Initiate Intelligent Conversation

Offer Risk Mitigation Recommendations

Digitize Application Flow

Enhance Customer Experience

Streamline your processes with automated online applications and risk assessments, all customized with your own branding.

How it works?

Integrate Application Flow with your branding

Broker Website or Email Channel

Initial Application

Quick qualifier application to assess inherent risk

Automated Risk Based Underwriting Questionnaire

Detailed risk-based assessment

Transmit to Insurers

Risk Adjustment Factors & Cyber Maturity Report

Potential New Revenue

Improve Cyber Risk Posture of Insured

How it works?

Onboard customer with FREE subscription

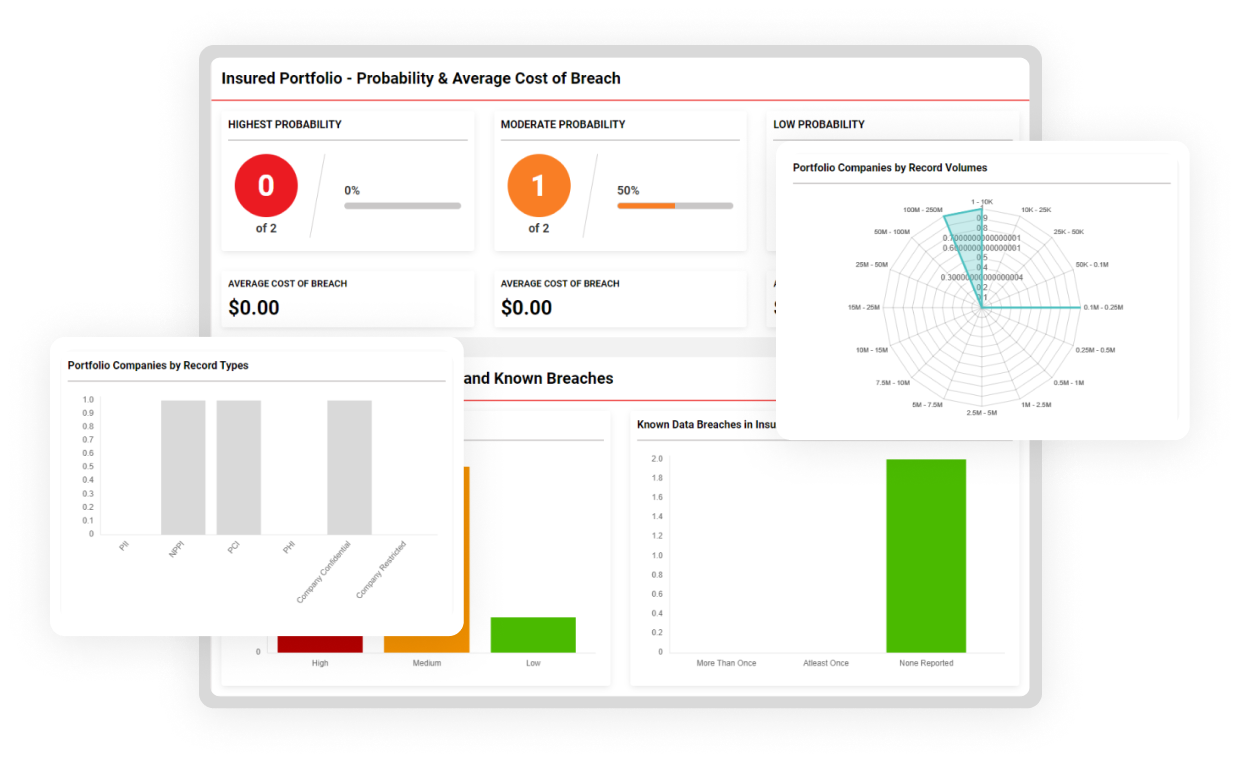

A Risk & Compliance platform for your insured

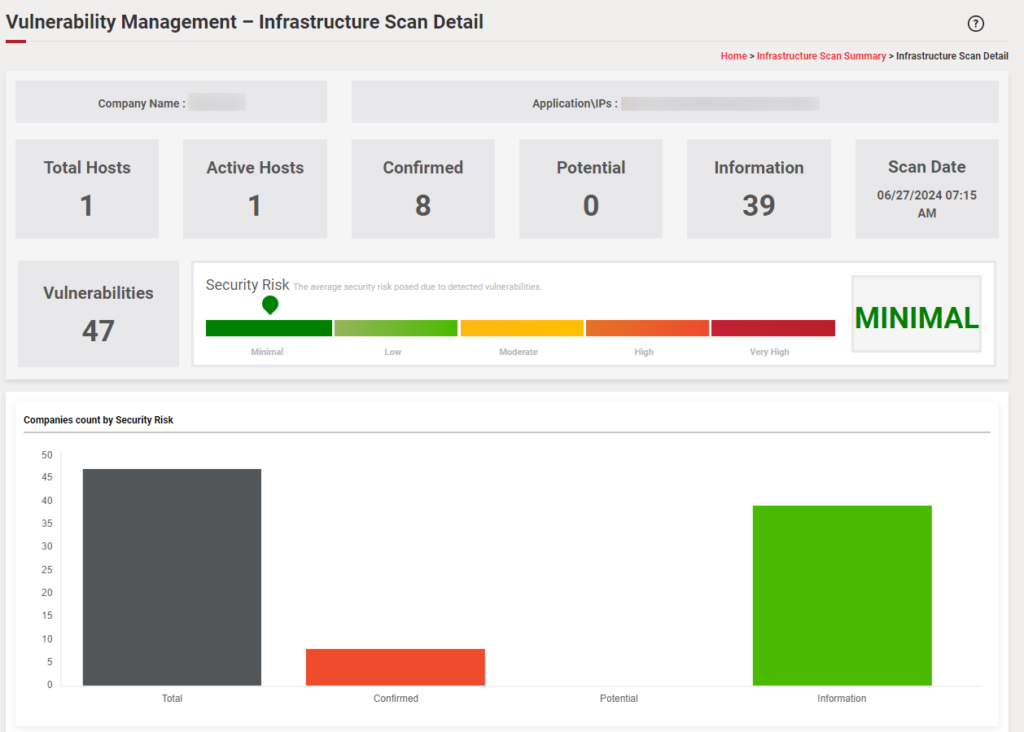

Monitor Cyber Vulnerabilities

Perform periodic vulnerability assessments

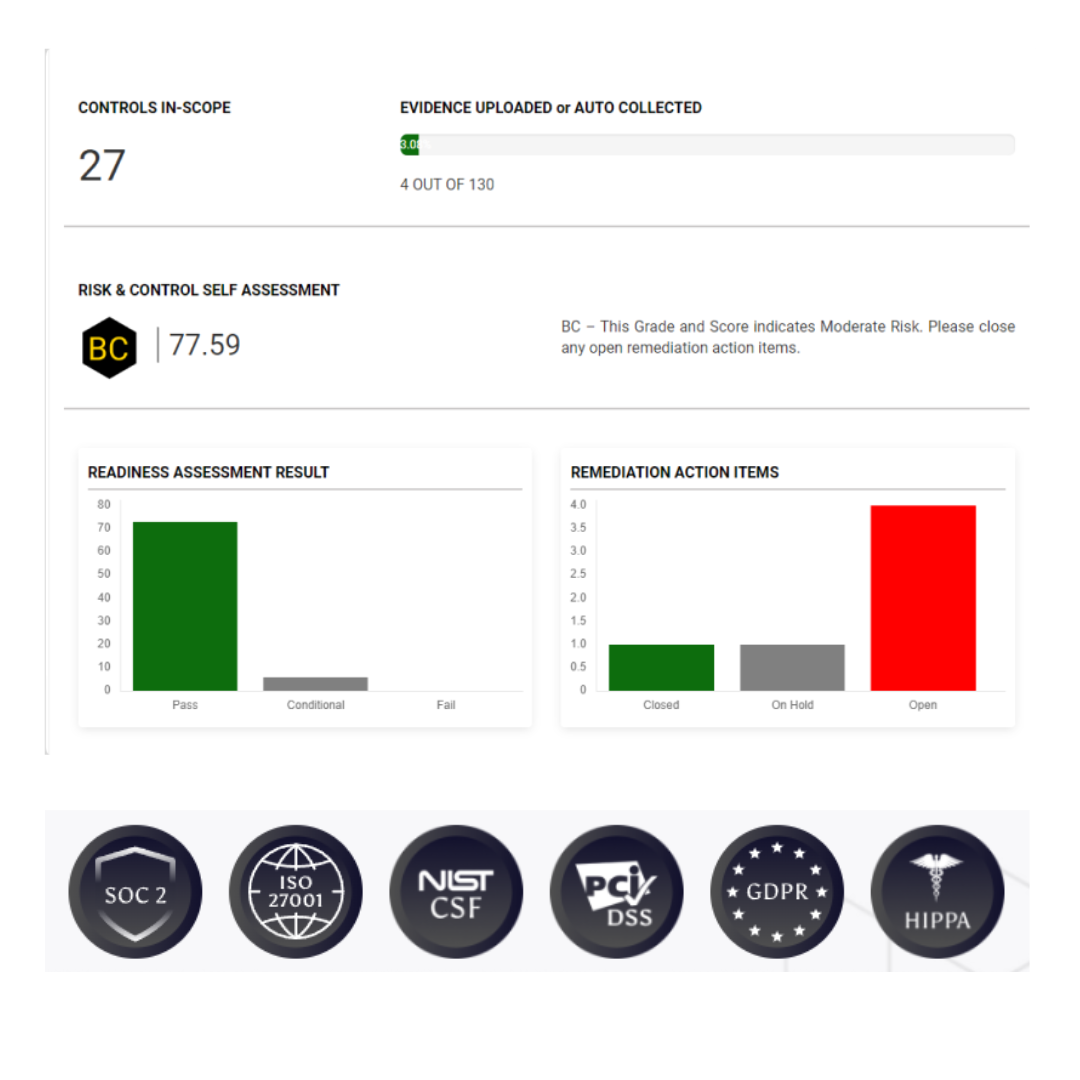

Risk & Control Assessments

Guidance on Security and Risk Reducing Controls

Certifications & Compliance

Stay compliant with policies, controls and regulations

Stay Compliant

Regulatory Compliance

Stay ahead of the game, confidently navigating the regulatory guidelines related to cybersecurity, privacy and third-party risks, thus safeguarding your professional standing.

How it works?

Perform a Compliance Readiness

We provide an easy compliance checklist

Leverage our ready framework

All control requirements are readily available

Conduct an Internal Assessment & Audit

Leverage our risk assessment and audits module

Become Compliant

Stay Compliant year after year

ISO/IEC 27001 is the world’s best-known standard for information security management systems (ISMS).

In the rapidly evolving digital landscape, businesses face an unprecedented level of cyber threats,

- Legal and civil damages: Paying for legal representation and possible damages related to a privacy or network security breach;

- Security breach remediation and notification expenses: Notifying affected parties and mitigating potential harm from a privacy breach, such as providing free credit monitoring;

- Forensic investigations expenses: Hiring a firm to investigate the root cause and scope of the data breach;

- Computer program and electronic data restoration expenses: Restoring or recovering damaged or corrupted data caused by a breach, denial-of-service attack or ransomware.

- Data confidentiality breaches: The loss of and/or unauthorized access to or disclosure of confidential or personal information;

- Cyber extortion: A demand for payment under threat of causing harm to your data; for example, disabling your operations or compromising your confidential data;

- Technology disruptions: A technology failure or denial-of-service attack.

- How many records containing personal information does your organization retain or have access to?

- How many records containing sensitive commercial information does your organization retain or have access to?

- What security controls can you put in place to reduce the risk of having your system compromised?

- Do all portable media and computing devices need to be encrypted?

- Is unencrypted media in the care, custody or control of your third-party service providers?

- Could you make a claim if you were unable to detect an intrusion until several months or years had passed?