In an era where data security and privacy are paramount, businesses handling sensitive information

SMART

Prospecting

- Effectively market and sell more Cyber Insurance 10x faster and grow top line.

- Prospect Qualifier

- Cyber Risk Intelligence

- Estimated Cost of Cyber Breach

SMART

Underwriting

- Easily assess the cyber risk of your insured. Easily manage multiple insurer applications.

- AI Risk Scoring Model

- Human Risk Scoring Model

SMART

Cyber Resilience

- Generate additional revenue stream by providing Risk Management solutions to your clients.

- Cyber risk management solution for insured

- Embedded cyber warranty protection up to $1M.

Sell More Cyber Insurance, Sell Fast

Smart Prospecting

How it works?

Easily Build a Portfolio & Qualify Prospects

Let our Prospect Qualifier AI Agent research target companies and generate insightful reports to support early-stage engagement.

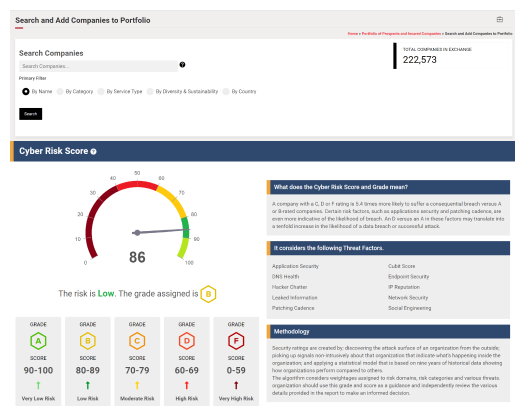

Generate a Cyber Risk Intelligence Report

Our Cyber Score Reviewer AI Agent helps brokers present risk findings clearly and assess risk selection with confidence.

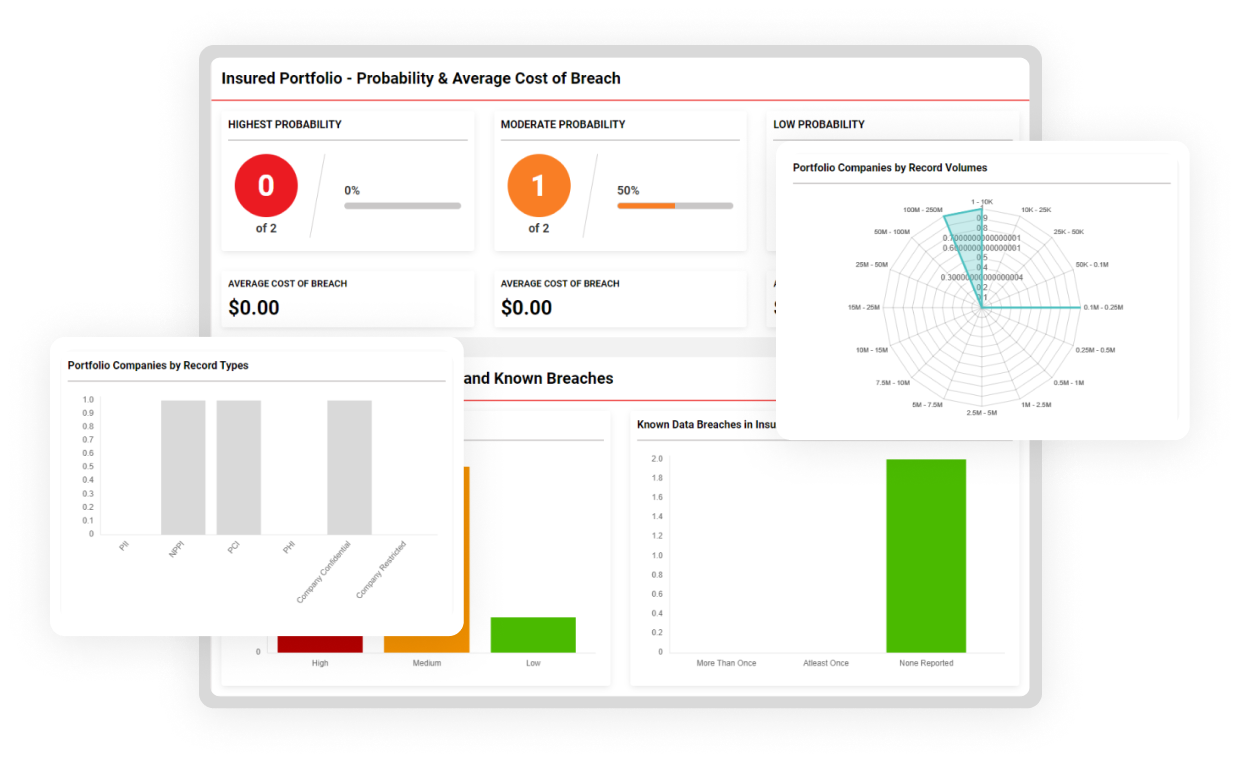

Estimate the Cost of a Cyber Breach

Leverage the Cost of Cyber Breach AI Agent to estimate potential financial impact and guide appropriate coverage limits.

Offer Risk Mitigation Recommendations

Empower clients to proactively reduce cyber exposure with actionable insights and tailored recommendations.

Enhance underwriting decisions

SMART Underwriting

How it works?

Digitize and Integrate Insurance Applications

Digitize the insurance application flows and enhance customer experience

AI-Based Risk Scoring to increase underwriting confidence

Leverage our UnderwriterAssist AI Agent to assess risk of your insured.

Human-Based Risk Scoring

Leverage your existing risk scoring models.

Cyber Risk Quantification & Breach Analysis

Leverage our BreachCostEstimator AI Agents to assess cost of cyber breach

Strengthen cyber resilience for the insured

SMART Cyber Resilience

How it works?

Provide a FREE BASIC Subscription of ComplySec360™

Increase client retention by offering free cyber risk management solution to your insured clients.

Security and Privacy Compliance

Help insured clients stay compliant with cybersecurity and privacy guidelines leveraging easy-to-use tools

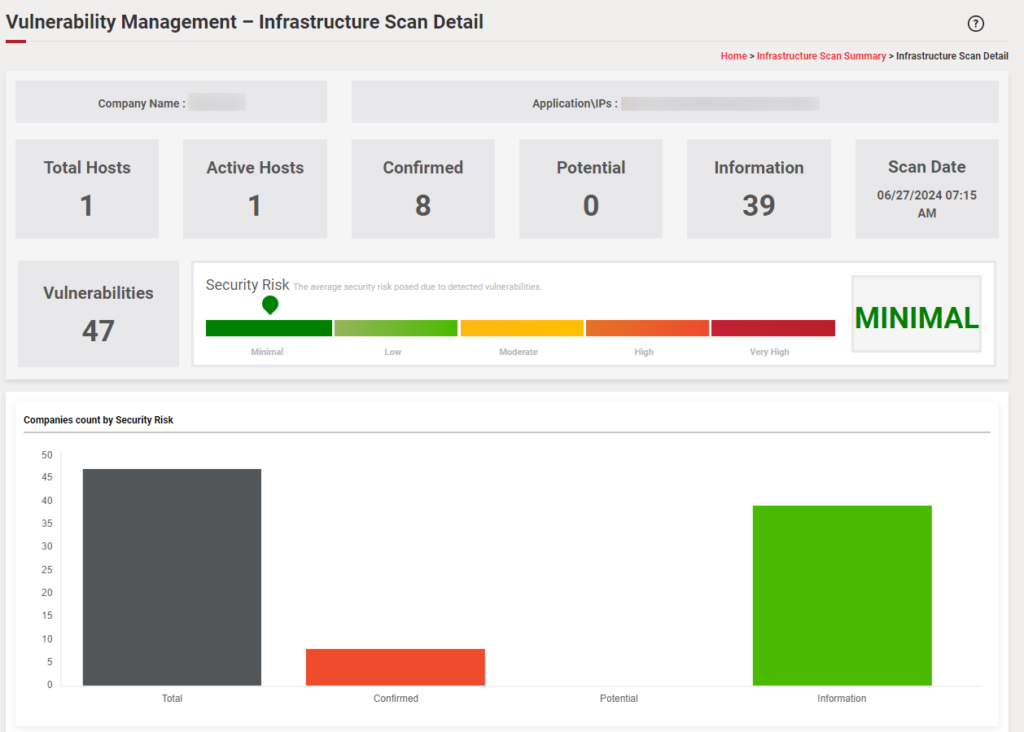

Cyber Risk Management Services

Provide access to periodic vulnerability assessments and monitoring, remediation advise.

Offer $500,000 to $1M in Cyber Warranty Protection

Insured client can use it as a deductible buy-back within their cyber insurance policy.

ISO/IEC 27001 is the world’s best-known standard for information security management systems (ISMS).

In the rapidly evolving digital landscape, businesses face an unprecedented level of cyber threats,

Businesses more than ever will need to protect from financial losses and ensure Cyber Insurance is part of their coverage. We can help your organization improve your risk posture.

Cyber insurance, also known as cybersecurity insurance, is a type of business liability insurance that protects your business against cyber security risks and data breaches. Cyber insurance can help restore employee and customer identities, recover compromised data and repair damaged computers and networks, whether your business is the victim of a data breach, social engineering, ransomware or phishing attack.

Your business could be at risk for a cyber attack. A growing number of small and medium-sized enterprises (SMEs) get attacked each year. Many businesses are without the support of cyber insurance coverage. The recent pandemic and increase in remote working makes computer systems more vulnerable. And if your systems or data are compromised, it can put you out of business or cause a significant financial loss.

85% of data breach insurance claims come from small to medium-sized businesses, and more than 60% of those businesses never recover from a data breach. Regularly backing up your data is one way to minimize the damage that can occur if your business is compromised. If a computer is stolen or your network is infected with a virus, for example, the backups can enable your business to get back on its feet sooner. Talk to us. We can help.

- Legal and civil damages: Paying for legal representation and possible damages related to a privacy or network security breach;

- Security breach remediation and notification expenses: Notifying affected parties and mitigating potential harm from a privacy breach, such as providing free credit monitoring;

- Forensic investigations expenses: Hiring a firm to investigate the root cause and scope of the data breach;

- Computer program and electronic data restoration expenses: Restoring or recovering damaged or corrupted data caused by a breach, denial-of-service attack or ransomware.

Improve your risk posture : We can help your organization improve your risk posture by implementing security controls to mitigate risk. Talk to our experts today.

- Data confidentiality breaches: The loss of and/or unauthorized access to or disclosure of confidential or personal information;

- Cyber extortion: A demand for payment under threat of causing harm to your data; for example, disabling your operations or compromising your confidential data;

- Technology disruptions: A technology failure or denial-of-service attack.

- How many records containing personal information does your organization retain or have access to?

- How many records containing sensitive commercial information does your organization retain or have access to?

- What security controls can you put in place to reduce the risk of having your system compromised?

- Do all portable media and computing devices need to be encrypted?

- Is unencrypted media in the care, custody or control of your third-party service providers?

- Could you make a claim if you were unable to detect an intrusion until several months or years had passed?

- Enhanced Sales Effectiveness: Equip your sales team with data-driven insights to engage prospects with meaningful cybersecurity conversations, leading to higher conversion rates.

- Improved Risk Selection: Use the Cyber Risk Intelligence Report to assess and qualify risks more accurately, ensuring a well-informed underwriting process.

- Optimized Coverage Recommendations: Leverage the Estimated Cost of a Cyber Breach report to justify appropriate coverage limits, helping clients understand their financial exposure.

- Value-Added Client Offerings: Provide clients with actionable risk mitigation strategies, differentiating your brokerage with proactive cyber risk management.

- Increased Policy Sales & Retention: Demonstrating cybersecurity expertise builds trust with clients, making them more likely to purchase and renew cyber insurance policies.

- Access to Pre-Qualified Leads: Easily pull company profiles from our database, streamlining prospecting and reducing the time spent on unqualified leads.

This approach ensures that brokers not only sell more cyber insurance policies but also add significant value to their clients, fostering long-term relationships.

- Competitive Differentiation & Value-Added Offering: Stand out from other brokers by providing a unique, embedded Cyber Warranty Protection of $500,000 to $1M, giving insured clients an extra layer of financial security.

- Deductible Buy-Back: The warranty can be used as a deductible buy-back, reducing the financial burden on insured clients and increasing their confidence in the insurance policy.

- Stronger Client Relationships & Retention: Offering proactive risk management services, including vulnerability assessments, control guidance, and compliance support, helps clients improve their cyber resilience, increasing policy renewals and customer loyalty.

- Reduced Claims & Improved Underwriting: By equipping clients with risk assessments, monitoring, and remediation guidance, insured companies are less likely to suffer cyber incidents, resulting in lower claims and better pricing from underwriters.

By integrating Cyber Warranty Protection from ENGAIZ, brokers not only help clients mitigate cyber risks but also create a more compelling and profitable insurance offering.

- Brand-Enhanced Client Experience: Offer a seamless, fully branded application process through your website or email channel, reinforcing trust and professionalism.

- Faster & More Efficient Client Onboarding: Automate the initial qualification process with a quick assessment, allowing brokers to identify high-potential prospects instantly.

- Data-Driven Risk Selection & Underwriting: Utilize an Automated Risk-Based Underwriting Questionnaire to gather detailed risk insights, improving underwriting accuracy and reducing manual effort.

- Streamlined Insurer Communication: Easily transmit risk assessment data to insurers, including risk adjustment factors and a Cyber Maturity Report, expediting policy approvals and improving pricing negotiations.

- Higher Conversion Rates & Increased Sales: By simplifying the application process and using risk intelligence to pre-qualify clients, brokers can close more deals efficiently.

- Better Risk Management & Client Satisfaction: Providing clients with an automated, structured assessment helps them understand their cyber risks, making them more likely to invest in coverage and risk mitigation strategies.

- Scalability & Time Savings: Reduce administrative burden through automation, allowing brokers to focus on selling and advising clients instead of processing paperwork.